Top 5 Money Saving Apps

By Jonathan Owen

By Jonathan Owen Marketing Manager

Published

19th December 2022

Last modified 31st July 2024

Last modified 31st July 2024

loveit? shareit!

Saving money can be a challenging task, especially in today’s economy where it seems like everything is constantly on the rise. However, with the help of technology and the abundance of money-saving apps available, it’s easier than ever to keep track of your finances and make smart decisions about where to allocate your hard-earned cash.

We will be exploring some of the top money-saving apps that can help you budget, invest, and save money. From apps that help you save on everyday purchases to those that allow you to track your spending and set financial goals, there is an app for every type of saver.

By using these tools, you can take control of your financial future and make sure that you are making the most of your money. Whether you are a beginner or an experienced saver, these apps can provide valuable resources and insights to help you reach your financial goals.

This popular UK-based bank offers a free app that helps you track your spending, set budgets, and get instant notifications when you make a purchase.

The Monzo app is a personal finance app that offers a range of features to help you save money. Here are a few examples:

Remember to carefully consider your financial goals and needs before using any financial app, and be sure to read reviews and compare features to find the best one for you.

Airbnb is a popular platform that allows users to book short-term rentals such as apartments, houses, and vacation homes. Using Airbnb to book accommodations for your trip can potentially save you money compared to booking a traditional hotel, especially if you are traveling with a group or need more space than a standard hotel room.

Here are a few ways that Airbnb can help you save money on your next trip:

It’s worth noting that Airbnb prices can vary depending on the location, availability, and demand for a particular rental. To get the best deal on Airbnb, it’s a good idea to compare prices across multiple listings and book in advance if possible.

The PetrolPrices app is a mobile application that allows users to search for the lowest fuel prices at petrol stations near their location. By using the PetrolPrices app, you can potentially save money on fuel by finding the cheapest prices at petrol stations in your area.

Here are a few ways the PetrolPrices app can help you save money on fuel:

By using the PetrolPrices app, you can potentially save money on fuel by finding the lowest prices at petrol stations near you, and by staying informed about trends in fuel prices. However, it’s always a good idea to compare prices across multiple sources to ensure you are getting the best deal.

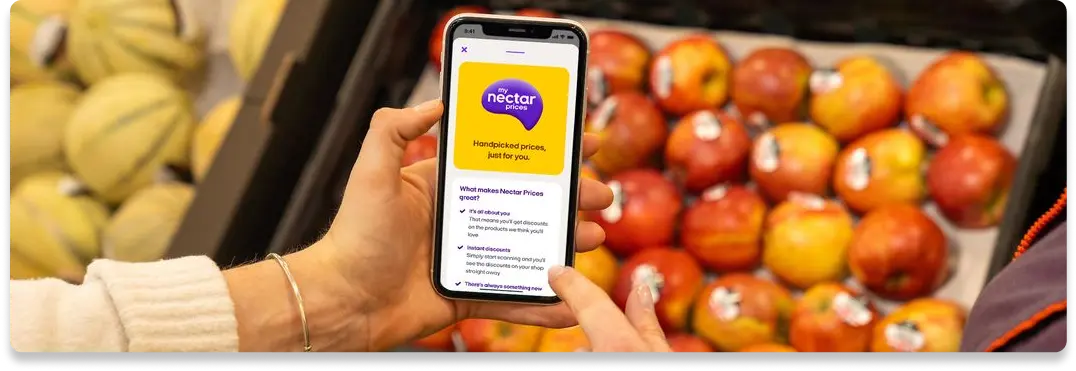

The Nectar app allows you to earn points for making purchases at participating retailers, including Sainsbury’s, Argos, and eBay. These points can then be redeemed for discounts on future purchases or exchanged for rewards, such as gift cards or experiences.

Here are a few ways you can use the Nectar app to save money:

Please take note that the value of your points may vary depending on how you choose to redeem them, so be sure to compare the value of different redemption options to find the best deal.

TopCashback is a cashback website and app that allows you to earn money back on purchases you make at participating retailers. Here are a few ways you can use TopCashback to save money:

With TopCashback you can earn and the participating retailers may vary, so be sure to check the terms and conditions of the program before making a purchase.

In summary, Money-saving apps can be a useful tool for anyone looking to better manage their finances and save money. By setting financial goals, tracking your spending, and finding discounts and promotions, you can take control of your financial situation and make the most of your money.